Mutual Funds

Mutual funds are a popular investment vehicle for both novice and experienced investors. They offer a way to pool money together with other investors to purchase a diversified portfolio of stocks, bonds, or other securities, managed by professional fund managers. This guide will delve into what mutual funds are, why investors choose them, the different types of mutual funds available, their relation to market returns, and an overview of the last ten years’ earnings data for mutual funds.

Thank you for reading this post, don't forget to subscribe!

What are mutual funds?

A mutual fund is a financial vehicle made up of a pool of money collected from many investors to invest in securities such as stocks, bonds, money market instruments, and other assets. Mutual funds are operated by professional money managers who allocate the fund’s assets and attempt to produce capital gains or income for the fund’s investors. The mutual fund’s portfolio is structured and maintained to match the investment objectives stated in its prospectus.

Key features of mutual funds include:

- Diversification: By investing in a variety of assets, mutual funds reduce the risk of significant losses.

- Professional Management: Fund managers are experienced professionals who make investment decisions on behalf of the investors.

- Liquidity: Mutual fund shares can be easily bought and sold, providing investors with liquidity.

- Affordability: Mutual funds allow small investors to buy into a diversified portfolio with relatively low initial investment amounts.

Why mutual funds?

Investors choose mutual funds for several reasons, including:

- Diversification: Mutual funds spread investments across various assets, which helps in reducing risk. A diversified portfolio means that poor performance of a single security is less likely to have a significant impact on the overall portfolio.

- Professional Management: Mutual funds are managed by professionals who have the expertise and resources to conduct thorough research and make informed investment decisions.

- Accessibility and Affordability: Mutual funds are accessible to small investors who may not have the capital to invest in individual securities. Many funds have low minimum investment requirements.

- Liquidity: Mutual funds can be easily bought or sold at the end of each trading day at the net asset value (NAV), providing flexibility for investors.

- Variety of Choices: There are mutual funds available for nearly every type of investor, including those seeking growth, income, or preservation of capital.

- Regulation and Transparency: Mutual funds are regulated by governmental bodies such as the Securities and Exchange Commission (SEC) in the United States, ensuring transparency and protection for investors.

Types of Mutual Funds

Mutual funds can be categorized based on their investment objectives, the type of assets they invest in, and their structure. Here are the main types of mutual funds:

- Equity Funds: These funds invest primarily in stocks and aim for capital appreciation. They can be further categorized into:

- Large-Cap Funds: Invest in large, well-established companies.

- Mid-Cap Funds: Invest in mid-sized companies with potential for growth.

- Small-Cap Funds: Invest in smaller companies with higher growth potential but also higher risk.

- Sector Funds: Focus on specific sectors such as technology, healthcare, or energy.

- Fixed-Income Funds: Also known as bond funds, these invest in bonds or other debt securities and aim to provide regular income. Types include:

- Government Bond Funds: Invest in government securities.

- Corporate Bond Funds: Invest in bonds issued by companies.

- Municipal Bond Funds: Invest in municipal bonds issued by state or local governments.

- Balanced Funds: These funds invest in a mix of stocks and bonds to provide a balance of growth and income.

- Index Funds: These funds aim to replicate the performance of a specific index, such as the S&P 500. They are passively managed and generally have lower fees.

- Money Market Funds: These invest in short-term, low-risk securities like Treasury bills and certificates of deposit. They aim to provide liquidity and safety with modest returns.

- International/Global Funds: Invest in securities outside the investor’s home country. Global funds invest worldwide, including the investor’s home country, while international funds exclude the home country.

- Specialty Funds: These include a variety of funds that focus on specific strategies or sectors, such as real estate, commodities, or socially responsible investing (SRI) funds.

Mutual Funds and Market Returns

Mutual funds are “subject to market returns,” meaning their performance is influenced by the fluctuations in the market. This inherent volatility can lead to both gains and losses. Here’s a closer look at how market conditions affect mutual funds:

- Market Risk: Equity funds are particularly susceptible to market risk, where the value of stocks in the fund can fluctuate based on market conditions.

- Interest Rate Risk: Fixed-income funds are influenced by interest rate changes. When rates rise, bond prices typically fall, affecting the fund’s performance.

- Credit Risk: Bond funds also face credit risk, where the issuer of a bond may default on payments.

- Economic Factors: Overall economic conditions, such as inflation, economic growth, and geopolitical events, can impact mutual fund performance.

10 Years Returns of Mutual Funds SIP

Systematic Investment Plans (SIPs) are a popular way for investors to regularly invest in mutual funds. By investing a fixed amount periodically, investors can benefit from rupee cost averaging and potentially reduce the impact of market volatility. Here’s a detailed look at the returns from a SIP in some top-performing mutual funds over the past 10 years.

1. Nippon India Small Cap Fund

- 10-Year SIP Returns: 25.4%

- Fund Overview: This fund primarily invests in small-cap companies with high growth potential. Over the past decade, it has consistently delivered strong returns, making it a popular choice among investors looking for high growth.

- Performance: If you had invested ₹10,000 monthly over 10 years, your total investment of ₹12,00,000 would have grown significantly, reflecting the high returns of the fund.

2. Quant ELSS Tax Saver Fund

- 10-Year SIP Returns: 24.8%

- Fund Overview: This Equity Linked Savings Scheme (ELSS) offers tax benefits under Section 80C and invests in a diversified portfolio of equities.

- Performance: A monthly SIP of ₹10,000 in this fund over 10 years would have resulted in substantial wealth creation, thanks to its robust performance in the equity markets.

3. Quant Active Fund

- 10-Year SIP Returns: 22.2%

- Fund Overview: The Quant Active Fund invests across market capitalizations, aiming for long-term capital appreciation.

- Performance: A consistent monthly investment in this fund would have grown remarkably over 10 years, demonstrating the benefits of active management and a diversified approach.

4. HDFC Mid-Cap Opportunities Fund

- 10-Year SIP Returns: 20.3%

- Fund Overview: This fund focuses on mid-cap companies, which are typically companies with a market capitalization between ₹5,000 crore and ₹20,000 crore.

- Performance: With a consistent SIP of ₹10,000, the fund’s strong performance in the mid-cap segment would have led to significant wealth accumulation over the past decade.

5. ICICI Prudential Technology Fund

- 10-Year SIP Returns: 19.2%

- Fund Overview: This fund invests in technology and technology-enabled companies. The tech sector’s growth over the past decade has been substantial, and this fund has capitalized on that trend.

- Performance: A SIP of ₹10,000 in this fund would have benefited from the explosive growth in the tech sector, resulting in impressive returns over the decade.

6. SBI Magnum Midcap Fund

- 10-Year SIP Returns: 18.8%

- Fund Overview: This fund invests in mid-cap stocks, offering a balance between high growth potential and relatively lower risk compared to small caps.

- Performance: Regular investments in this fund would have yielded substantial returns, showcasing the potential of mid-cap investments.

8. Parag Parikh Flexi Cap Fund

- 10-Year SIP Returns: 18.5%

- Fund Overview: This fund offers flexibility in its investment approach, investing across market capitalizations and sectors.

- Performance: The flexibility and strategic approach of this fund would have resulted in robust returns over a 10-year SIP.

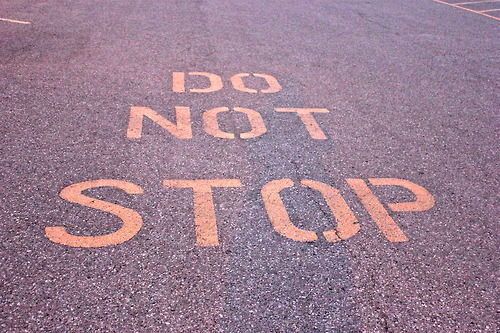

Why You Should Not Stop SIP

- Why you should not stop SIP is considering your long term goals and recent market fluctuation may be taken care by regular investment in the same funds for a long term. Are you looking at your funds’ one-year returns and wondering if something is wrong? The last you saw the returns chart, say December 31, 2017, most equity funds delivered 25% plus one-year returns. You see your funds’ one-year chart now and they are in low single digits or even negative.

- How can the return picture change so dramatically in six months? – you ask yourself and suspect your fund of slipping down the returns chart.

- Now, this is often a trigger for many of you to conclude that your fund is not doing okay and stop the SIPs. And there begin your woes.

- Investment in Mutual Funds SIP are subject to market returns, Please read offer documents fully.

- Stopping SIPs, unless you know your fund is a definite underperformer, can harm your portfolio. That is to put it mildly.

- If you were saving for a goal, then stopping SIPs can be short of being disastrous for the following reasons:

- One, you lose out on the best periods to average your costs, when the NAV is trending down

- Two, you would stop installments, thereby upsetting the whole time frame over which you intended to save for the goal.

- Stopping SIP would not only decreases your investments but it also stops averaging your previously purchased units. Disrupting the SIP it would mean losing out the potential upside. The stock market, with its currently moderate earnings fundamentals and economic growth besides an upcoming election year, is likely to see enhanced volatility. That means markets and NAVs can see-saw.

- Next thing why you should not stop SIP is 3-4 months is too short a period to conclude a fund is poor even if it under performs its index or category average.

- Temporary blips are bound to happen if a call or two goes wrong (and it is bound to, for any fund). That should not cause panic in a long-term wealth creating process.

- SIP, as a method of investment, has proven to safeguard you from market falls by taking advantage of such falls. What you should be more concerned about is if your time period and risk appetite are in line with your choice of equity instrument. With that being the basis of your investment decision, refraining from investing because the market is falling will only be counterproductive.

Investing through SIPs in mutual funds can be an effective way to build wealth over the long term. The above examples illustrate how different types of mutual funds have performed over the past decade, showing the potential benefits of regular, disciplined investing. When selecting funds for SIPs, investors should consider their risk tolerance, investment horizon, and financial goals. Historical performance, while not indicative of future results, provides a valuable benchmark for evaluating fund performance.

Mutual Funds Tax Rules

- If a fund is stopped and the investment is withdrawn with 1 year, the Short term Capital gain Tax would be 15% + cess + surcharge. At the same time if the redemption is done after one year from the date of investment, upto Rs. 1,00,000/- is tax-exempted. All profit withdrawal of more than Rs. 1,00,000/- would attract Long term capital gain tax of 10% + cess + surcharge.

- Equity Linked Savings Scheme which is mainly for tax savings, cannot be withdrawn within 3 years from the investment date.

- The moral is, don’t let the market spook you into getting off your investment track. A SIP will work in all market cycles. It will work exceptionally well when the market sees a correction. There is only one scenario when a SIP won’t work, that is when you stop it.

We are just a call away. Whatsapp or call us at 9886568000