Capital Gain Bonds: Save tax under Capital Gain Tax

Section 54 EC – Capital Gain Bonds

Capital Gain Bonds, or 54EC bonds, are a source to save tax when an individual receives capital gains from selling a property. To save the tax from the profit made after the sale of the property, investment up to Rs. 50,00,000/- only (Rs. 50 Lakhs only) can be done.

Thank you for reading this post, don't forget to subscribe!

The benefits of Capital Gain bonds (54-EC) bonds are:

- These bonds are backed by the Government of India, hence, the risk factor is mitigated.

- Long term Capital gain from the sale of the property can be reinvested in order to save tax

- the investor not only saves tax by investing, but they also earn interest income till the maturity time.

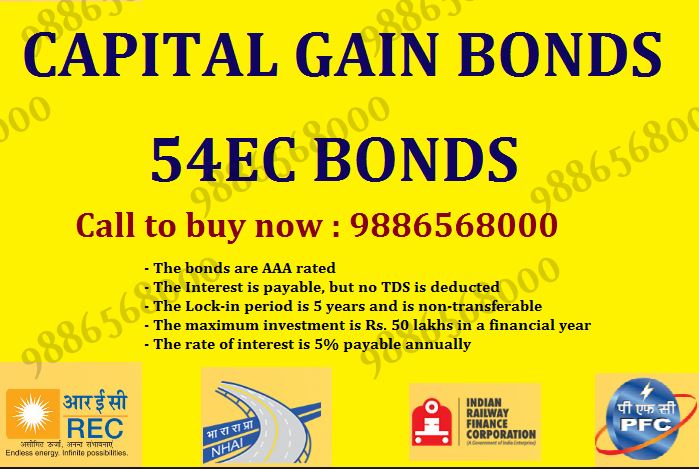

The Features of Capital Gain Bonds :

- The bonds are AAA rated

- The Interest is payable, but no TDS is deducted

- The Lock-in period is 5 years and non-transferable

- The maximum investment is Rs. 50 lakhs in a financial year

- The rate of interest is 5% payable annually

The companies issuing 54EC Bonds are :

- Power Finance Corporation

- National Highways Authority of India

- Indian Railway Finance Corporation

- REC Limited

To know more information and buy Capital Gain Bonds (54EC), call us at 9886568000