Heart Health Insurance for heart patients in India

Thank you for reading this post, don't forget to subscribe!

Health insurance for heart patients

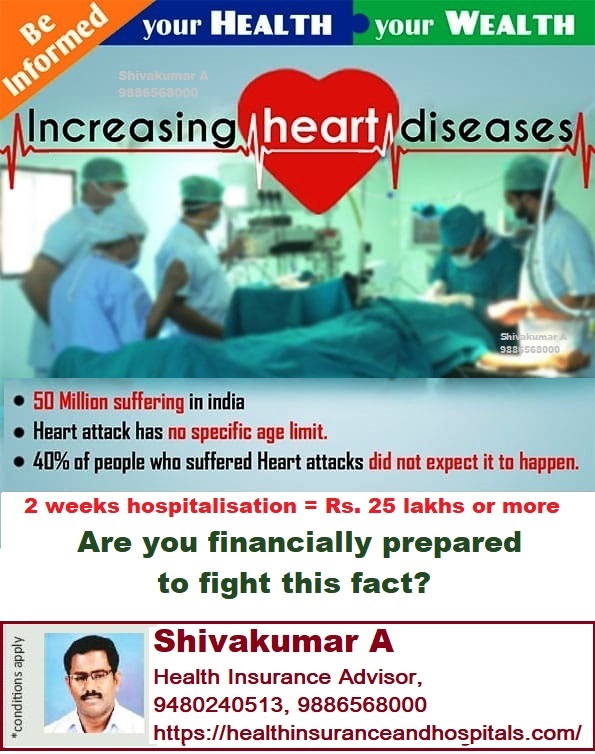

Heart disease is one of the leading causes of death in India, with millions of people suffering from cardiovascular conditions such as coronary artery disease, heart attacks, and heart failure. For heart patients, managing medical expenses can be overwhelming, especially given the high costs of treatments, surgeries, and medications. This is where heart health insurance plays a crucial role.

A specialized health insurance plan for heart patients ensures financial protection and access to quality healthcare. If you or a loved one is a heart patient, it is essential to choose the best plan that offers comprehensive coverage and immediate benefits. For expert guidance, call 9886568000 to find the best health insurance cover tailored to your needs.

Why Heart Health Insurance is Essential for Heart Patients

- Rising Medical Costs: Heart treatments, including angioplasty, bypass surgery, and pacemaker implantation, can cost lakhs of rupees. Without adequate insurance, these expenses can drain savings and push families into debt.

- Frequent Medical Needs: Heart patients often require regular check-ups, diagnostic tests, and medications, which can add up to significant costs over time. A good health insurance plan covers these recurring expenses.

- Emergency Situations: Heart attacks and other cardiac emergencies can occur without warning. Having a health insurance plan ensures that you can access immediate medical care without worrying about the financial burden.

- Comprehensive Coverage: Specialized heart health insurance plans cover hospitalization, pre- and post-hospitalization expenses, diagnostic tests, and even alternative treatments like cardiac rehabilitation.

- Peace of Mind: Knowing that you are financially protected allows you to focus on recovery and maintaining a healthy lifestyle.

How to choose the best health insurance Plans for Heart Patients in India

Give us an opportunity to choose the best cashless treatment for your heart wellness at the best hospitals near you. Getting health insurance after a heart attack in India can be challenging, but it is possible. Many insurers offer health insurance policies to individuals with a history of heart disease or heart attacks, but these policies typically come with certain conditions.

-

Waiting Periods: Health insurance providers often impose waiting periods for pre-existing conditions. For heart patients, this waiting period could range from 2 to 4 years. During this time, heart-related treatments may not be covered under the policy.

-

Higher Premiums: If you’ve had a heart attack, insurance premiums might be higher due to the increased risk. The premium amount will reflect the individual’s health status and medical history.

-

Exclusions: Some insurers may exclude certain heart conditions or treatments from the coverage for the first few years of the policy. It’s crucial to read the fine print to understand what is covered.

-

Critical Illness Coverage: Some insurers offer critical illness plans that cover heart attacks and related surgeries, with a lump sum payout upon diagnosis. These policies can help cover the costs of treatment, recovery, and loss of income during the recovery period.

-

Post-Hospitalization Benefits: Most policies include post-hospitalization benefits, which cover follow-up treatments, medication, and consultations after discharge.

-

Existing Policies: If you already have health insurance before your heart attack, check with your insurer about the terms and conditions for coverage after the heart attack. Some plans may continue to cover treatments for heart conditions once the waiting period has passed.

Immediate Coverage for Heart Patients

For heart patients, waiting periods for pre-existing conditions can be a significant concern. Heart patients are of fear for the future; there are heart patients who don’t have any insurance cover. However, some insurers offer plans with shorter waiting periods or immediate coverage for specific conditions. To find the best plan with immediate coverage, call (9886568000) and speak to a health insurance expert who can guide you through the process.

Why call Shivakumar A at 9886568000?

- Providing Insurance services since 2007

- Expert Advice: Get personalized recommendations based on your medical history and financial needs.

- Compare Plans: Understand the features, benefits, and premiums of different plans to make an informed decision.

- Immediate Assistance: Receive help with policy documentation, claims, and renewals.

Heart health insurance is a lifeline for heart patients in India, providing financial security and access to quality healthcare. By choosing the right plan, you can ensure comprehensive coverage for heart-related treatments and peace of mind for yourself and your family. Don’t wait—call 9886568000 today to secure the best health insurance cover for heart patients and protect your heart health for years to come.