Why buy ULIP now when mutual funds are performing?

Why Buy ULIPs Now with Life Insurance Cover?

Unit-Linked Insurance Plans (ULIPs) have gained considerable popularity as they combine life insurance coverage with investment options. While mutual funds are currently delivering strong returns and are often seen as a go-to investment vehicle, there are compelling reasons why investors—particularly new ones—should consider ULIPs even in a thriving mutual fund market.

Thank you for reading this post, don't forget to subscribe!

Dual Benefits of Insurance and Investment

One of the primary advantages of ULIPs is that they offer a combination of insurance protection and market-linked investment. When you buy a ULIP, a portion of your premium is allocated toward life insurance coverage, while the remaining amount is invested in equity, debt, or hybrid funds based on your risk preference. This dual benefit is unmatched by mutual funds, which purely focus on investment returns.

Tax Benefits Under Sections 80C and 10(10D)

ULIPs offer significant tax benefits. The premiums paid for a ULIP are eligible for deduction under Section 80C of the Income Tax Act, up to a limit of Rs. 1.5 lakh per financial year. Additionally, the maturity proceeds are tax-free under Section 10(10D) provided certain conditions are met, such as the premium not exceeding 10% of the sum assured.

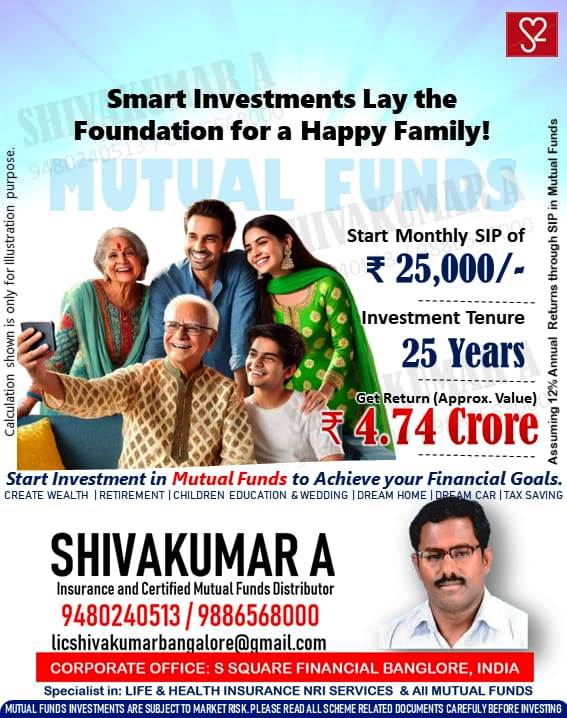

Mutual funds, on the other hand, are subject to capital gains tax. Equity mutual funds attract a 10% long-term capital gains tax on gains exceeding Rs. 1 lakh per year, while debt funds are taxed based on your income slab.

Flexible Investment Options

ULIPs allow policyholders to switch between different fund options—equity, debt, or balanced—based on changing market conditions or personal risk tolerance. Most insurers offer a certain number of free switches annually, giving investors greater control over their investments without incurring additional charges.

In contrast, mutual funds require you to redeem and reinvest if you wish to shift between fund categories, often leading to tax implications and exit load charges.

Long-Term Wealth Creation

ULIPs are designed as long-term investment instruments, typically with a lock-in period of five years. This encourages disciplined investing and helps investors ride out market volatility to achieve long-term financial goals such as children’s education, marriage, or retirement planning.

While mutual funds also offer long-term investment benefits, their open-ended nature may tempt investors to redeem prematurely, potentially disrupting long-term financial planning.

Cost Efficiency with Reduced Charges

Earlier, ULIPs were criticized for their high charges. However, regulatory changes by the Insurance Regulatory and Development Authority of India (IRDAI) have capped these charges, making modern ULIPs more cost-efficient. Premium allocation, fund management, and mortality charges have all seen reductions, improving net returns for policyholders.

Mutual funds, while often perceived as low-cost investments, still come with expense ratios that can affect long-term returns.

Risk Management Through Life Cover

The life insurance component of ULIPs provides a safety net for the investor’s family in the unfortunate event of the policyholder’s demise. This ensures that financial goals are not derailed even in adverse circumstances.

Mutual funds do not offer any insurance coverage, making them purely investment products without a protective element.

Goal-Based Investment Options

ULIPs are structured to help investors meet specific financial goals. Insurers often provide tailored ULIP plans for education, retirement, or wealth creation, allowing investors to align their investment strategy with life objectives.

Mutual funds, while flexible, do not inherently come with such goal-based structuring.

Ideal for New Investors

For new investors seeking a balanced approach to financial planning, ULIPs offer a convenient way to start investing while simultaneously securing life insurance. The structured nature of ULIPs can help novice investors develop disciplined financial habits.

Mutual funds, though accessible, may require a higher level of market knowledge and active management, which can be daunting for beginners.

While mutual funds are performing well and remain an excellent investment option, ULIPs offer a unique value proposition by blending insurance with market-linked returns. For investors seeking long-term wealth creation, tax efficiency, and financial security for their families, ULIPs are a compelling option. They provide flexibility, risk management, and structured investment options that can be especially beneficial for new investors looking to build a strong financial foundation.