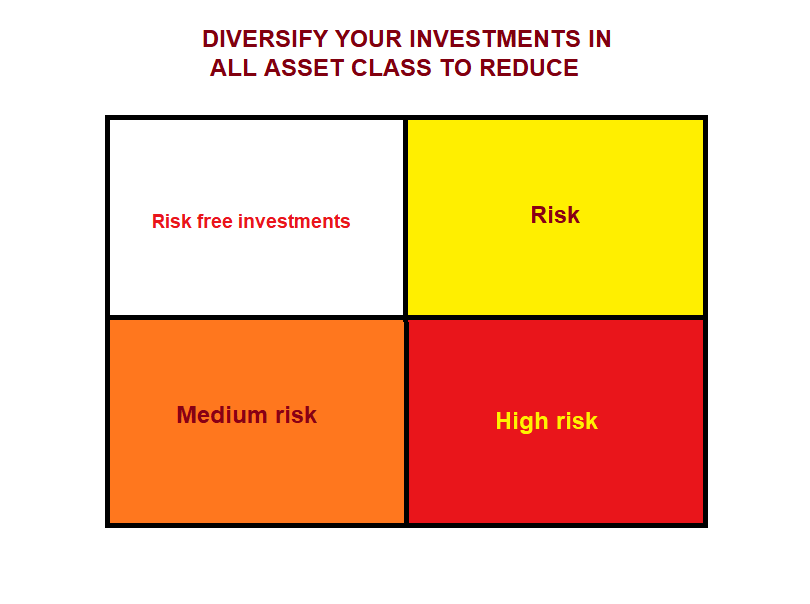

Diversify and Invest in all asset Classes to reduce risk

A Balanced Approach to Risk and Reward: call 9886568000

Investing is an essential part of building wealth, and one of the key principles to achieving long-term financial success is diversification. The concept of diversification involves spreading your investments across different asset classes to reduce risk and increase the potential for returns. By investing in a mix of asset types, you can create a portfolio that balances risk and reward, ensuring that you’re not overly exposed to any one market or economic condition.

Thank you for reading this post, don't forget to subscribe!

There are four primary categories of asset classes that investors typically consider: risk-free assets, low-risk assets, medium-risk assets, and high-risk assets. Each of these asset classes has distinct characteristics, and understanding them can help you make informed decisions that align with your financial goals and risk tolerance.

Planning is the key to all asset classes. A timely, proper plan with the experts would help the investor to make risk-free, healthy returns from his investments. Call 9886568000 for more information,

1. Risk-Free Assets

Risk-free assets are considered the safest form of investment. They typically include government bonds or treasury bills issued by highly rated governments, such as the U.S. Treasury. These investments are backed by the government, which is why they are regarded as “risk-free.” The returns on these assets are lower compared to other types of investments, but they offer stability and are generally unaffected by market volatility.

For investors with a low risk tolerance, risk-free assets can provide peace of mind and a steady income stream. They are particularly appealing to those nearing retirement or those who cannot afford to lose principal. While they may not generate significant returns, they are important for maintaining capital preservation and providing liquidity when needed.

2. Low-Risk Assets

Low-risk assets are generally considered to be more stable than high-risk investments but still carry some degree of risk. These can include investment-grade bonds, blue-chip stocks, and dividend-paying stocks. Bonds issued by corporations or municipalities with strong credit ratings fall into this category. Although these investments offer higher returns than risk-free assets, they are still relatively conservative.

For example, blue-chip stocks, which are shares of large, established companies with a track record of financial stability, can provide moderate growth with lower volatility compared to smaller or emerging market companies. Likewise, dividend-paying stocks are attractive to conservative investors who want to receive regular income while also benefiting from long-term capital appreciation.

These assets serve as a good choice for investors seeking to strike a balance between safety and growth potential. They are particularly useful for long-term goals where some degree of capital appreciation is desired, but not at the expense of significant risk.

3. Medium-Risk Assets

Medium-risk assets offer a balance between risk and potential return. This category includes a broad spectrum of investments, such as mid-cap stocks, real estate investment trusts (REITs), and diversified mutual funds or exchange-traded funds (ETFs). These assets have the potential for higher returns than low-risk investments but also come with increased volatility.

Mid-cap stocks, for instance, represent companies that are neither too large nor too small. They often offer more growth potential than blue-chip stocks but may also experience more significant price swings. Similarly, REITs provide exposure to the real estate market without the need to directly purchase property. Although the real estate market can be cyclical and subject to economic shifts, it often provides a hedge against inflation and generates steady income through dividends.

Investors in this category are typically looking for growth but are still mindful of risk. They may be in the accumulation phase of their investing journey and have a longer investment horizon, which allows them to ride out short-term market fluctuations.

4. High-Risk Assets

High-risk assets, also known as speculative investments, have the potential for substantial returns, but they also come with a higher chance of significant losses. These investments include small-cap stocks, emerging market investments, commodities, and cryptocurrencies.

Small-cap stocks are often companies in the early stages of development with high growth potential but can be highly volatile. Emerging markets, which include countries with developing economies, also present unique risks due to political instability, currency fluctuations, and less-developed legal frameworks. Commodities, such as oil or gold, can be influenced by supply and demand factors, geopolitical events, and other unpredictable forces. Cryptocurrencies, while growing in popularity, remain highly speculative and are subject to extreme volatility.

While these high-risk assets can yield impressive returns, they are not suitable for all investors. They are generally more appropriate for those with a high risk tolerance and a longer investment horizon, who can afford to absorb short-term losses in exchange for the potential of higher long-term gains.

Building a Balanced Portfolio

The key to successful investing lies in balancing these different asset classes in a diversified portfolio. By allocating your investments across risk-free, low-risk, medium-risk, and high-risk assets, you can reduce the overall volatility of your portfolio and better manage your exposure to potential losses.

For instance, if you have a higher risk tolerance and a long-term investment horizon, you may allocate more of your portfolio to medium-risk and high-risk assets, seeking greater growth potential. Conversely, if you are risk-averse or nearing retirement, you may choose to emphasize risk-free and low-risk assets to preserve your capital and provide steady income.

Diversification is not just about spreading investments across different asset classes but also across sectors, industries, and geographical regions. This reduces the impact of a downturn in any single market or asset class. By carefully considering your personal risk tolerance, financial goals, and time horizon, you can build a diversified portfolio that maximizes your chances for success while managing risk effectively.