LIC Bima Sakhi Yojana details and benefits online

The Life Insurance Corporation of India (LIC), a government-owned entity, has introduced the Bima Sakhi Yojana, a transformative initiative aimed at empowering women across the nation. Launched on December 9, 2024, by Prime Minister Narendra Modi in Panipat, Haryana, this scheme seeks to provide women with opportunities to become LIC agents, thereby promoting financial inclusion and enhancing insurance awareness, especially in rural areas.

Thank you for reading this post, don't forget to subscribe!The primary goal of the Bima Sakhi Yojana is to empower women by offering them a platform to achieve financial independence. By training women to become insurance agents, the scheme aims to:

- Enhance financial literacy: Equip women with knowledge about insurance products and financial planning, enabling them to educate their communities.

- Promote insurance penetration: Increase the reach of insurance services in rural and underserved areas through trained female agents.

- Create Employment Opportunities: Provide a respectable and financially rewarding career path for women across various age groups.

Become a Woman LIC Insurance Advisor—call: 9886568000

Eligibility Criteria to become LIC Bima Sakhi

To participate in the Bima Sakhi Yojana, applicants must meet the following criteria:

- Age: Women aged between 18 and 70 years are eligible to apply.

- Educational Qualification: A minimum educational qualification of passing the 10th standard (Class X) is required.

- Residency: While the scheme is open to all eligible women, preference is given to those residing in rural areas to bolster insurance outreach in these regions.

Training and Stipend Structure

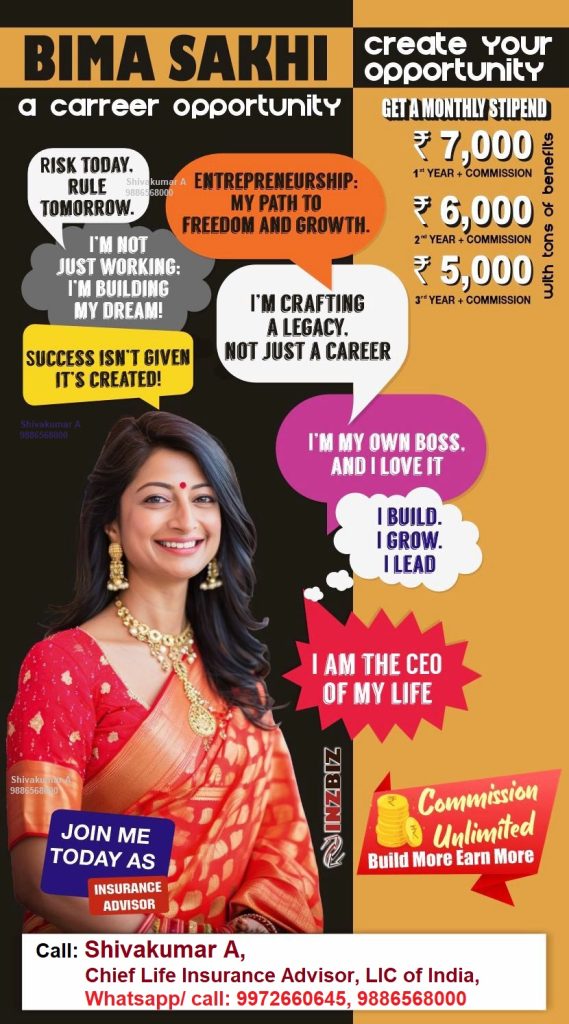

The Bima Sakhi Yojana offers a comprehensive training program spanning three years, during which participants receive specialized instruction on LIC’s insurance products, financial literacy tools, and the importance of insurance. To support the trainees during this period, LIC provides a monthly stipend as follows:

- First Year: ₹7,000 per month

- Second Year: ₹6,000 per month (subject to at least 65% of policies completed in the first stipendiary year being in force at the end of the corresponding month of the second stipendiary year)

- Third Year: ₹5,000 per month (subject to at least 65% of policies completed in the second stipendiary year being in force at the end of the corresponding month of the third stipendiary year)

In addition to the stipend, participants earn commissions based on the insurance policies they secure, with earnings increasing in proportion to the business they bring in.

Post-Training Opportunities

Upon successful completion of the three-year training program, participants are designated as LIC insurance agents, known as Bima Sakhis. In this role, they are responsible for:

- Educating Communities: Raising awareness about the benefits of insurance and guiding families to select policies that best suit their needs.

- Financial advisory: assisting individuals in making informed decisions regarding financial planning and risk management.

Furthermore, graduates of the program who hold a bachelor’s degree may be considered for Development Officer roles within LIC, offering avenues for career advancement.

Impact and Future Prospects

The Bima Sakhi Yojana has witnessed a remarkable response, with over 50,000 registrations within a month of its launch. LIC aims to enroll 1,00,000 women under this scheme in the first year, with a vision to have at least one Bima Sakhi in every panchayat across the country. This initiative not only empowers women but also strengthens LIC’s outreach, ensuring that insurance services penetrate deeper into rural India.

LIC Bima Sakhi Yojana stands as a testament to the organization’s commitment to social welfare and financial inclusion. By empowering women to become financial advisors and insurance facilitators, the scheme fosters economic independence among women and enhances the accessibility of insurance services in underserved regions. As a fully government-owned entity, LIC continues to play a pivotal role in shaping India’s financial landscape, with initiatives like the Bima Sakhi Yojana leading the way toward a more inclusive and secure future.

For more detailed information and to apply for the Bima Sakhi Yojana, interested individuals can 9886568000

LIC Bima Sakhi Yojana details and benefits