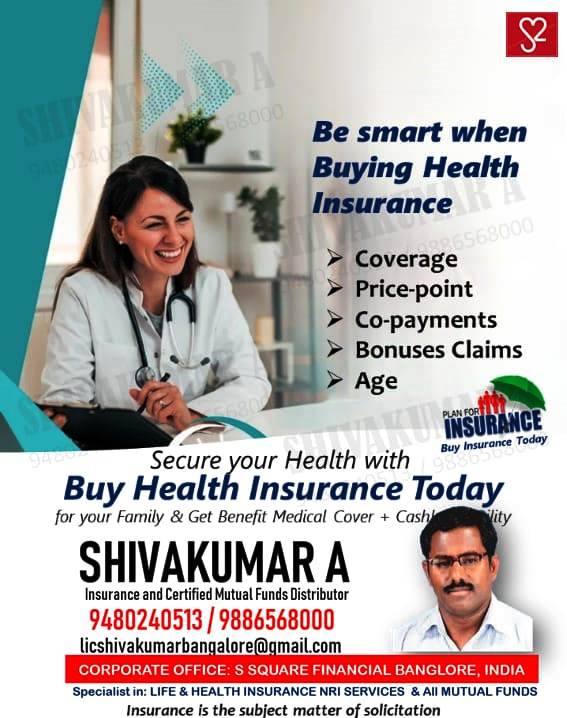

Buy Best Health Insurance now

Affordable Health Insurance plans for all

Thank you for reading this post, don't forget to subscribe!Health insurance plays a vital role in safeguarding individuals and families from unforeseen medical expenses, particularly in a bustling city like Bangalore. Known as the Silicon Valley of India, Bangalore offers a plethora of health insurance options tailored to meet diverse needs, ranging from individual health plans to specialized insurance for seniors, cardiac care, diabetic care, and more. This article explores various health insurance plans available in Bangalore, helping residents make informed decisions.

Individual Health Plans

Individual health insurance plans cater specifically to the healthcare needs of a single person. These plans typically cover hospitalization costs, pre- and post-hospitalization expenses, diagnostic tests, and sometimes even outpatient consultations. For Bangalore’s working professionals and freelancers, individual health plans offer a sense of security against rising healthcare costs. Many insurers in Bangalore also provide cashless treatment options at a network of hospitals, making it convenient for policyholders to access quality healthcare without worrying about upfront payments.

Family Floater Health Plans

Family floater health plans are designed to cover an entire family under a single policy. These plans are ideal for nuclear families in Bangalore, as they provide coverage for spouses, children, and sometimes even dependent parents. The sum insured under a family floater plan can be utilized by any member of the family, ensuring flexibility and comprehensive protection. With Bangalore’s fast-paced lifestyle, such plans are a popular choice for families seeking a cost-effective way to ensure everyone’s health needs are met.

Senior Citizen Health Plans

Senior citizen health insurance plans are specifically crafted for individuals aged 60 years and above. As medical expenses tend to increase with age, these plans offer higher coverage for ailments common among the elderly, such as arthritis, diabetes, and hypertension. Many insurers in Bangalore provide senior citizen plans with features like domiciliary hospitalization, annual health check-ups, and coverage for pre-existing diseases after a waiting period. Such plans offer peace of mind to families caring for elderly members.

Cardiac Care Insurance

Cardiac care insurance is a specialized health plan designed for individuals with heart conditions or those at risk of developing cardiac issues. Given the rising incidence of heart diseases in urban centers like Bangalore, these plans cater to the growing need for comprehensive cardiac care. Coverage typically includes expenses for surgeries, hospitalization, rehabilitation, and sometimes even post-operative care. These plans ensure that individuals with pre-existing heart conditions are not excluded from essential medical coverage.

Diabetic Care Insurance

Diabetes is a prevalent health concern in Bangalore, owing to lifestyle factors and stress. Diabetic care insurance plans are tailored to meet the unique healthcare requirements of individuals with diabetes. These plans cover expenses related to diabetes management, including diagnostic tests, medication, hospitalization, and treatment for complications arising from the condition. Insurers in Bangalore often collaborate with leading hospitals and diagnostic centers to provide specialized services to policyholders.

Personal Accident Insurance

Accidents can happen anywhere, and in a bustling city like Bangalore, the risk is amplified due to heavy traffic and fast-paced living. Personal accident insurance provides financial protection against accidental injuries, disability, or death. These policies offer coverage for medical expenses, compensation for loss of income due to temporary or permanent disability, and even educational benefits for the policyholder’s children. Such plans are invaluable for individuals who frequently commute or engage in physically demanding occupations.

Travel Insurance

Travel insurance is essential for individuals and families who frequently travel, whether domestically or internationally. Bangalore’s residents, known for their global presence, often invest in travel insurance to safeguard against unexpected events like medical emergencies, trip cancellations, loss of baggage, or passport theft. These policies provide a safety net, ensuring that unforeseen circumstances do not derail travel plans.

Choosing the Right Health Insurance Plan

With the myriad of options available, choosing the right health insurance plan in Bangalore can be overwhelming. It is essential to assess one’s specific healthcare needs, consider the coverage and exclusions of each plan, and compare premiums across insurers. Consulting with insurance advisors or utilizing online comparison tools can help in identifying the most suitable plan.

At the end, health insurance is an indispensable investment for Bangalore’s residents, offering protection against the escalating costs of medical care. Whether it’s an individual health plan, family floater, or a specialized policy like cardiac or diabetic care insurance, the right coverage ensures peace of mind and financial security in times of need.