Child Education and your savings to beat inflation

Child education is a must. Every child has the right to study, as per our constitution. Investing in your child’s education requires careful planning to outpace inflation and ensure sufficient funds. Start by estimating future educational costs and incorporating a savings strategy that targets these expenses. As education starts at age 4 and continues until age 22, a lot of investment has to be made with proper planning. Consider investing in diversified portfolios or education-specific savings plans, like 529 plans or mutual funds, which offer growth potential over time.

Thank you for reading this post, don't forget to subscribe!Proper planning with regular contributions and leveraging compounding can help your savings keep up with inflation. Additionally, explore scholarship opportunities and financial aid options to supplement your savings. By planning early and adjusting your investment strategy, you can better manage rising costs and provide your child with a quality education.

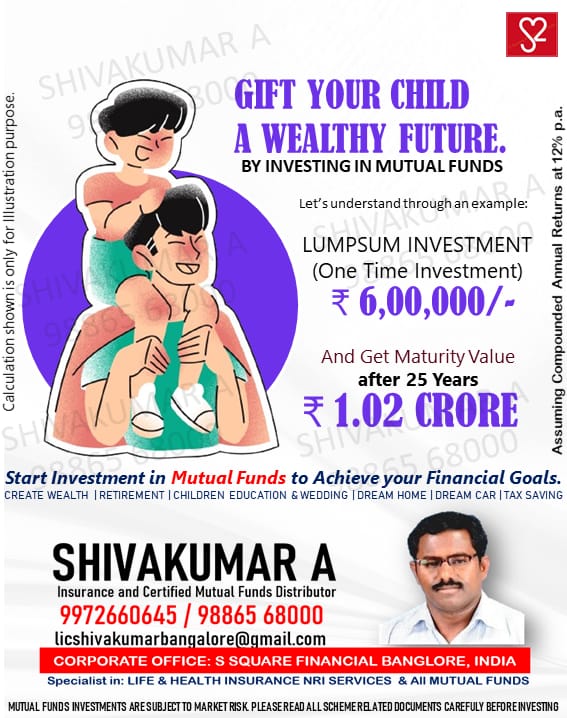

Beat inflation by investing in mutual funds.