Buy LIC Policy online: 9886568000

Thank you for reading this post, don't forget to subscribe!

It’s easy to buy Insurance policy and save tax

Buy LIC policy online at 9972660645 by calling the best Advisor

because you also need after-sales services.

Buy LIC Policy Online: A Simple Path to Insurance and Tax Savings

In today’s digital age, managing your finances and securing your future have never been easier, thanks to technological advancements. When you consider the future of the children and family, tax savings are nothing. Choose the plan, call Shivakumar at 9886568000, and start immediately. One of the most significant innovations in personal finance is the ability to buy insurance policies online. The Life Insurance Corporation of India (LIC), a trusted name in the Indian insurance sector, has embraced this shift, making it simpler than ever for individuals to purchase policies online. This article delves into the ease of buying LIC policies online and highlights the added benefit of tax savings associated with them.

Buy LIC Policy online – the easy way

1. Convenience at Your Fingertips

Gone are the days when purchasing an insurance policy meant visiting multiple offices, filling out lengthy forms, and spending hours navigating through bureaucratic procedures. With LIC’s online platform, you can now explore, compare, and buy policies from the comfort of your home or office. This shift to digital transactions has streamlined the process, making it much more convenient and less time-consuming.

2. Comprehensive Information and Comparison

LIC’s website offers a wealth of information about various policies, including detailed descriptions, benefits, and features. You can easily compare different plans based on your needs, budget, and long-term financial goals. The transparency provided through online platforms ensures that you make an informed decision without being pressured by sales representatives.

3. Simplified Application Process

Applying for an LIC policy online is straightforward. You start by selecting the policy that best suits your requirements. The application form is user-friendly and guides you through each step, from entering personal details to selecting premium payment options. Digital forms are designed to minimize errors and omissions, reducing the chances of delays in policy issuance.

4. Instant Policy Issuance

Once you’ve completed the online application and payment, the policy documents are processed and issued almost instantly. This immediate issuance ensures that your coverage starts right away, providing you with peace of mind knowing that you are protected from the very beginning.

5. Secure Transactions

Online transactions have become increasingly secure, thanks to advanced encryption technologies and robust cybersecurity measures. LIC’s online platform is designed to safeguard your personal and financial information, ensuring that your transactions are safe and confidential.

Tax Benefits of LIC Policies

Purchasing an LIC policy not only provides financial security but also offers significant tax advantages under the Income Tax Act of 1961. Here’s how investing in LIC policies can help you save on taxes:

Buy LIC Policy online for the best Section 80C Deductions

One of the most appealing tax benefits of LIC policies is the deduction available under Section 80C of the Income Tax Act. You can claim a deduction of up to ₹1.5 lakh per annum on premiums paid for LIC policies. This deduction is applicable not just for policies bought in your name but also for policies bought for your spouse, children, and even parents.

2. Exemption on Maturity Proceeds

The maturity proceeds of LIC policies are exempt from tax under Section 10(10D) of the Income Tax Act, provided the policy meets certain conditions. This means that the amount received on maturity, including bonuses and any other benefits, is tax-free, allowing you to enjoy the full benefit of your policy without worrying about additional tax liabilities.

3. Tax-Free Death Benefits

In the unfortunate event of the policyholder’s death, the death benefit received by the nominee is also tax-exempt under Section 10(10D). This ensures that the financial protection intended for your loved ones is delivered without any tax deductions, providing them with the full sum assured.

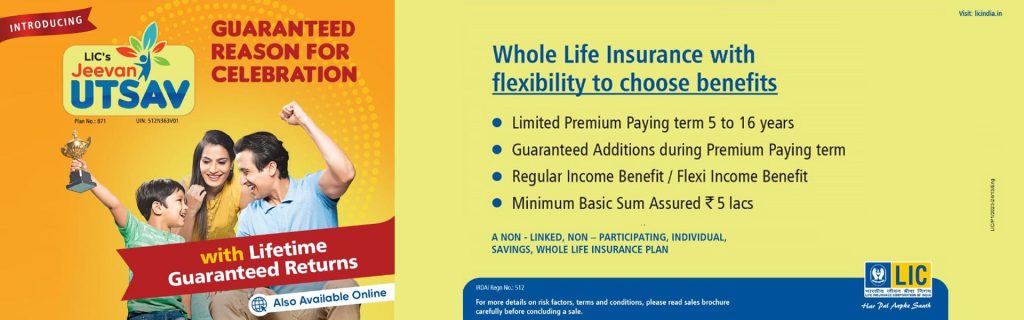

4. Wealth Accumulation

Certain LIC policies, like endowment plans and ULIPs (Unit Linked Insurance Plans), not only offer insurance coverage but also serve as investment tools. The wealth accumulated through these policies can be reinvested or used for future expenses, and the growth is subject to tax benefits under relevant sections of the Income Tax Act.

How to Maximize Tax Benefits with LIC Policies

1. Choose the Right Policy

To make the most of tax benefits, choose a policy that aligns with your financial goals and offers optimal coverage. The plan is to insure and invest for the future. For instance, endowment policies combine life insurance with investment, while ULIPs offer the flexibility of investing in various funds. Understanding the features and benefits of each policy type will help you make an informed choice that maximizes your tax savings.

2. Plan Premium Payments Strategically

To fully utilize the Section 80C deduction, plan your premium payments in a way that you can claim the maximum allowable deduction of ₹1.5 lakh. The premium of LIC Life Insurance should not affect the routine work of the family. This might involve paying premiums annually or semi-annually, depending on your policy terms and financial situation.

3. Keep Track of Policy Documents

Maintain a record of all policy-related documents, including premium receipts and policy statements. LIC of India online portal registration is very easy for the policyholder. This documentation is essential for claiming tax benefits and should be kept safe for future reference during tax filing.

4. Review and Update Policies Regularly

Life circumstances change, and so do financial needs. LIC agents play a big role in the servicing aspect. Regularly reviewing and updating your policies ensures that your coverage remains adequate and that you continue to benefit from available tax advantages. Consult with LIC representatives or financial advisors if needed to align your policies with your current financial situation.

Buying an LIC policy online from Shivakumar A @ 9972660645 or 9886568000 offers unparalleled convenience, allowing you to manage your insurance needs efficiently from anywhere. The added advantage of tax savings further enhances the attractiveness of LIC policies, making them a valuable component of your financial planning strategy. By leveraging the benefits of online purchasing and understanding the tax advantages, you can secure your financial future and optimize your tax savings with ease.

So, take the plunge into the digital world of insurance with LIC and start reaping the rewards of simplified processes and enhanced financial benefits today.