Insurance Agent Bangalore

In today’s fast-paced world, financial security and planning have become paramount. One of the key components of a sound financial plan is insurance. Life Insurance Corporation (LIC) of India, a household name, offers various policies to cater to different needs. For those in Bangalore looking to secure their future with an LIC policy, the process has become simpler and more accessible thanks to the role of insurance agents and the convenience of online purchases.

Thank you for reading this post, don't forget to subscribe!

The Importance of Insurance

Insurance is a fundamental aspect of financial planning. It provides a safety net against unforeseen events, ensuring that individuals and their families are financially protected. Life insurance, in particular, offers peace of mind by guaranteeing financial support in the event of the policyholder’s demise. It also serves as an investment tool, helping policyholders save and grow their wealth over time.

LIC: A Trusted Name in Life Insurance

Established in 1956, LIC is the largest and most trusted life insurance provider in India. With a wide range of policies tailored to meet various needs—be it term insurance, endowment plans, money-back policies, or pension plans—LIC has a solution for everyone. The corporation’s strong presence and reliable services have made it a preferred choice for millions of Indians.

The Role of Insurance Agents

Insurance agents play a crucial role in bridging the gap between the insurance company and its customers. In Bangalore, a city known for its technological advancements and busy lifestyle, insurance agents provide personalized services that cater to the unique needs of each client. Here are some of the key roles they play:

- Advisory Services: Insurance agents offer expert advice on the different types of policies available and help clients choose the one that best fits their financial goals and risk appetite.

- Tailored Solutions: Every individual has different insurance needs based on their age, income, dependents, and financial goals. Insurance agents assess these factors to recommend policies that provide optimal coverage.

- Ease of Access: Agents simplify the process of buying insurance by handling all the paperwork, explaining the terms and conditions, and ensuring that clients understand the benefits and obligations associated with their policies.

- Claims Assistance: In the unfortunate event of a claim, insurance agents assist policyholders or their beneficiaries in navigating the claims process, ensuring a smooth and hassle-free experience.

Buying LIC Policies Online

The digital revolution has transformed how we purchase goods and services, and insurance is no exception. LIC has embraced this change by offering the option to buy policies online. Here’s how this benefits customers:

- Convenience: Purchasing insurance online allows individuals to browse through different policies, compare features, and make an informed decision from the comfort of their home.

- Time-Saving: The online process eliminates the need for multiple visits to an insurance office. With a few clicks, customers can complete the application process and receive their policy documents digitally.

- Transparency: The online platform provides detailed information about each policy, including premiums, coverage, and benefits, ensuring complete transparency.

- Customer Support: Despite the digital interface, LIC ensures robust customer support to assist with any queries or issues that may arise during the purchase process.

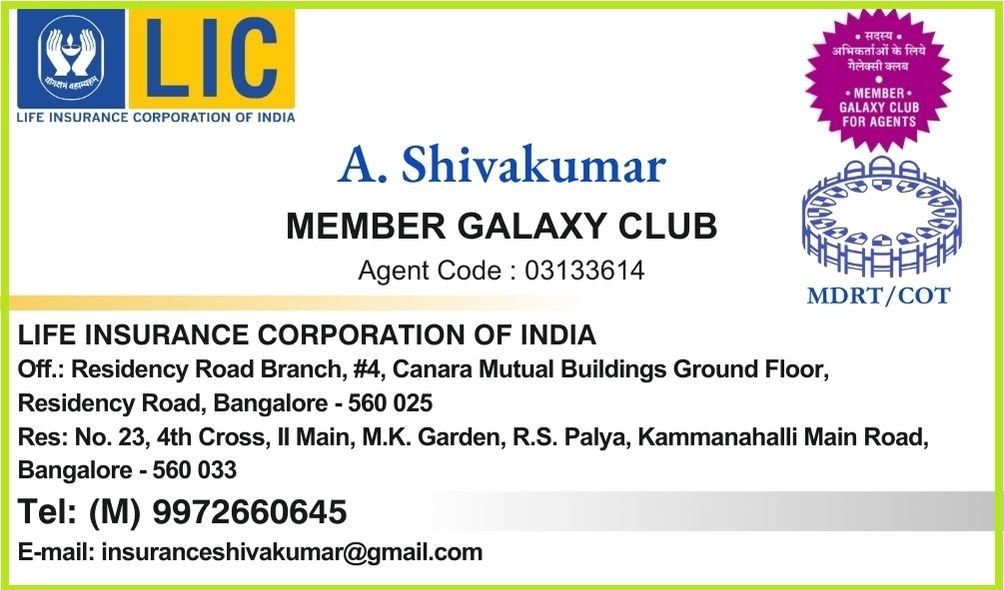

Contact Shivakumar A, Insurance Agent Bangalore buy LIC policy at 9972660645

The Synergy of Agents and Online Platforms

While online platforms offer convenience, the human touch provided by insurance agents remains invaluable. In Bangalore, insurance agents are leveraging technology to enhance their services. Here’s how they are creating a synergy between traditional and digital approaches:

- Personalized Online Assistance: Agents use digital tools to provide personalized recommendations and assistance. They guide clients through the online purchase process, ensuring they understand each step.

- Virtual Consultations: Through video calls and online meetings, agents offer the same level of advisory services that they would in a face-to-face meeting, thus maintaining a personal connection.

- Digital Documentation: Agents facilitate the submission of documents and other formalities online, making the entire process seamless and efficient.

- Enhanced Reach: By leveraging social media and other digital platforms, agents can reach a wider audience, educating potential clients about the importance of insurance and the benefits of LIC policies.

How to Buy an LIC Policy Online in Bangalore

For those looking to buy an LIC policy online in Bangalore, the process is straightforward. Here’s a step-by-step guide:

- Visit the Official LIC Website: Start by visiting the official LIC website (www.licindia.in).

- Browse Policies: Explore the different policies available. The website provides comprehensive details about each policy, including eligibility, benefits, and premium calculations.

- Use Online Tools: Utilize online calculators to estimate premiums and compare different policies based on your requirements.

- Contact an Agent: For personalized advice, reach out to an LIC agent. You can contact them via phone (e.g., 9886568000) or email to schedule a consultation.

- Complete the Application: Once you’ve decided on a policy, you can complete the application process online. Fill in the necessary details and submit the required documents.

- Make Payment: Choose from various payment options to pay your premium. LIC offers secure online payment gateways to ensure your transactions are safe.

- Receive Policy Documents: Upon successful payment and verification, you will receive your policy documents via email. You can also download them from the LIC website.

The landscape of insurance is evolving, with digital platforms enhancing accessibility and convenience. In Bangalore, insurance agents play a pivotal role in guiding clients through this evolution, combining their expertise with the advantages of online services. Whether you choose to buy an LIC policy online or through an agent, the goal remains the same: securing your financial future and providing peace of mind for you and your loved ones. With the right guidance and the ease of online processes, purchasing an LIC policy has never been simpler.