LIC Premium Paid Statement for Income Tax Filing

Filing income tax returns requires accurate documentation, including the premiums paid for your LIC policies. The LIC Premium Paid Statement serves as a crucial document for claiming tax deductions under Section 80C of the Income Tax Act.

Thank you for reading this post, don't forget to subscribe!

The problem is that nowadays most of the premium payments are made online or on a monthly bank Enach mode. LIC policyholders, already registered with the LIC Portal, can directly download from the portal; others can do what is given below. Here’s how you can get it:

easy step is to obtain LIC premium-paid statement for Income tax filing and other purposes

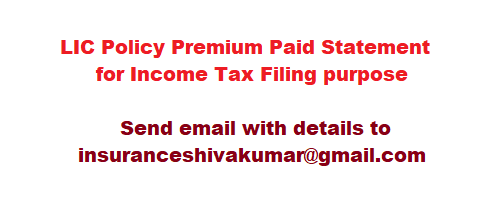

Email insuranceshivakumar@gmail.com with the following details:

- Name

- Policy number:

- LIC Statement for the year:

- Mobile number

- Email ID

- I Accept that my contact number and email ID will be used for sending LIC policyholder service and other important information

Another Step to Obtain a LIC Premium Paid Statement:

- Visit the LIC Website: Log in to your account on the official LIC website, LIC Portal.

- Navigate to ‘Policy Status’: Under the ‘Policy Tools’ section, click on ‘Policy Status’ to view all your active policies.

- Select ‘Premium Paid Certificate’: Choose the policy for which you need the statement and select the option to generate the premium paid certificate.

- Download or email: You can either download the statement directly or choose to have it emailed to your registered email address.

Alternatively, you can also request the statement by sending an email to LIC’s customer service at customercare@licindia.com. Mention your policy number, name, and request for the premium paid statement. LIC will send the statement to your registered email address free of charge.

Benefits:

- Tax filing is essential for claiming deductions under Section 80C.

- Record-keeping helps in maintaining accurate financial records.

- Convenience: easily accessible online or via email, making the process hassle-free.

Make sure to regularly check and download your premium paid statements to ensure you have all the necessary documents ready for your income tax filing.

LIC Premium paid statement for Income tax filing