Monthly Fixed Income Policy Over flats and land Investment

To start the investment, call : 9972660645

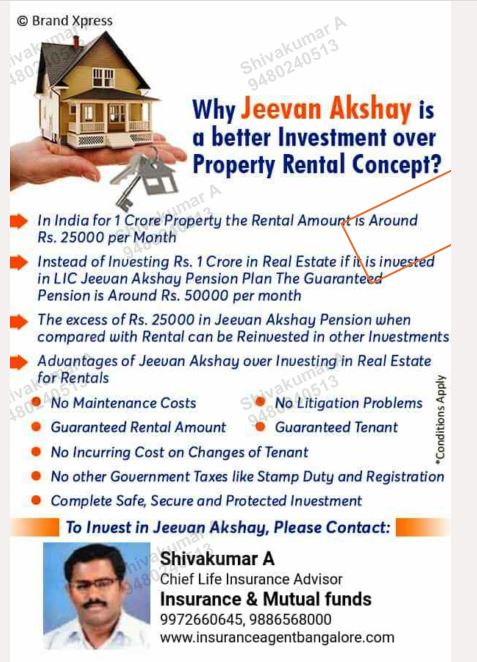

Thank you for reading this post, don't forget to subscribe!In the pursuit of financial security and wealth accumulation, individuals often weigh the pros and cons of various investment options, including real estate. However, in recent times, the real estate market has been marred by challenges such as land fraud, low rental yields, and escalating house taxes. In light of these hurdles, an alternative approach gaining traction is the adoption of monthly fixed income policies. In this insightful article, we delve into the rationale behind choosing a monthly fixed income policy over real estate investment amidst prevalent challenges, highlighting the benefits, considerations, and potential for long-term financial stability.

The Real Estate Conundrum: Challenges and Pitfalls

Real estate investment, once considered a safe haven for wealth creation, has encountered a myriad of challenges in recent years. Some of the prominent issues plaguing the real estate sector include:

- Land Fraud and Legal Hassles: Instances of land fraud and legal disputes have become increasingly prevalent, casting doubt on the legitimacy of property titles and ownership rights. Investors face the risk of investing in properties with dubious backgrounds, leading to potential legal entanglements and financial losses.

- Low Rental Yields: Despite substantial capital investment, rental yields in many real estate markets remain subdued. Factors such as oversupply, stagnant demand, and changing tenant preferences contribute to low rental income, diminishing the attractiveness of real estate as an investment avenue.

- Escalating House Taxes: Property owners are burdened with escalating house taxes imposed by local authorities, adding to the overall cost of property ownership. High tax liabilities reduce the net rental income, eroding the profitability of real estate investments.

- Maintenance and Upkeep Costs: Property maintenance and upkeep entail additional expenses for landlords, ranging from repairs and renovations to utilities and property management fees. These recurring costs diminish the net returns from rental income, impacting the profitability of real estate investments.

Today, flats or land are not available for Rs. 25 lakhs to Rs. 1 crore, which can give immediate returns of approx. 6.5%. Call me, 9972660645 to invest in the Monthly Fixed Income Policy over flats and land investments and get guaranteed monthly returns to your bank account every month. Interest rates are fixed for life.

Exploring Monthly Fixed Income Policies: A Viable Alternative

Amidst the challenges and uncertainties surrounding real estate investment, monthly fixed income policies emerge as a compelling alternative for individuals seeking stable returns and peace of mind. Key aspects that make monthly fixed income policies an attractive option include:

- Predictable Income Streams: Monthly fixed income policies offer a predictable stream of income, providing investors with financial stability and consistency in cash flows. Unlike real estate investments, which are subject to market fluctuations and tenant dynamics, fixed income policies offer reliable returns regardless of external factors.

- Risk Mitigation: By opting for monthly fixed income policies, investors mitigate various risks associated with real estate, such as land fraud, legal disputes, and market volatility. Fixed-income policies are backed by reputable financial institutions, offering assurance and security for investors’ capital.

- Tax Efficiency: Fixed-income policies may offer tax benefits and incentives, depending on the prevailing tax regulations. Investors can leverage tax-saving opportunities to enhance their overall returns and optimize their investment portfolios.

- Diversification and Flexibility: Monthly fixed income policies provide investors with the flexibility to diversify their investment portfolios across different asset classes. By allocating funds to fixed income instruments, investors can achieve a balanced portfolio that aligns with their risk tolerance and investment objectives.

Considerations When Choosing Fixed Income Policies

While monthly fixed income policies offer numerous benefits, investors should consider the following factors before making investment decisions:

- Interest Rates and Returns: Evaluate the interest rates and returns offered by various fixed income policies to ensure they align with your financial goals and income requirements. Compare the yields of different policies and select the ones that offer competitive returns with minimal risk.

- Investment Horizon: Determine your investment horizon and liquidity needs when selecting fixed income policies. Some policies may have lock-in periods or withdrawal restrictions, which could affect your ability to access funds when needed.

- Credibility of Issuer: Assess the credibility and financial stability of the institutions offering fixed income policies. Choose policies from reputable insurers or financial institutions with a track record of reliability and solvency.

- Diversification Strategy: Incorporate fixed income policies into your overall investment strategy as part of a diversified portfolio. Balance your investments across various asset classes to mitigate risk and optimize returns over the long term.

Why fixed income plan is the best for NRIs

- Safe and secure: NRIs investing from outside India, can feel safe with the investment. The funds are safe forever because they are invested in the Central Government’s guaranteed schemes.

- No tenant problems: There may be many problems in collecting the rent, taking care of the property, and protecting it from burglary, theft, and fire.

- Regular Income: The scheme will credit the pension amount every month, first week, without deducting any charges, directly to the bank account.

- Easy to liquidate: The scheme offers surrendering whenever required. It is a loss to the investor, but an option is available.

Conclusion: Navigating the Investment Landscape

In conclusion, the decision to opt for monthly fixed income policies over real estate investment reflects a strategic approach to wealth management and risk mitigation. Amidst the challenges and uncertainties prevalent in the real estate market, fixed-income policies offer stability, predictability, and peace of mind for investors. By diversifying their investment portfolios and exploring alternative avenues for wealth accumulation, individuals can navigate the investment landscape with confidence and resilience.

While real estate investment continues to hold allure for many investors, the evolving market dynamics and associated challenges underscore the importance of considering alternative options. Nowadays, there are many problems with rental income, finding a suitable person for rent, painting, Security, Insurance, house taxes, etc. Monthly fixed income policies present a viable alternative for individuals seeking stable returns, tax efficiency, and risk mitigation in their investment endeavors. As investors adapt to changing economic conditions and market trends, embracing a diversified approach to investment management becomes paramount for long-term financial success and prosperity.

To start the investment in the virtual estate plan,

Call Shivakumar 9972660645