Where to invest in 2024:

Expert Insights on Mutual Funds, Term Insurance, NHs, and Pension Transfers to India

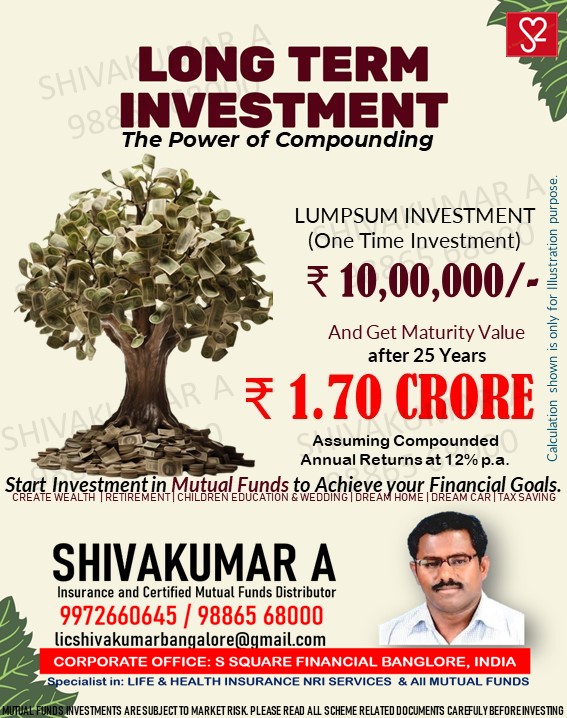

Thank you for reading this post, don't forget to subscribe!In the ever-evolving landscape of investments, the year 2024 presents a plethora of opportunities and challenges for investors seeking to optimize their portfolios. From mutual funds to term insurance, National Highways (NHs) projects, and pension transfers to India, the options are diverse and nuanced. To navigate this terrain, we turn to the expertise of Shivakumar A, a seasoned investment advisor from Bangalore, India, to shed light on the most promising avenues for investment in 2024.

Mutual Funds:

Mutual funds continue to be a cornerstone of diversified investment portfolios, offering investors access to a broad range of asset classes and professional management. In 2024, amidst economic uncertainties and market volatility, Shivakumar emphasizes the importance of a well-balanced mutual fund portfolio tailored to individual risk tolerance and investment objectives.

He recommends considering equity mutual funds for long-term wealth accumulation, particularly focusing on sectors poised for growth such as technology, healthcare, and renewable energy. Additionally, debt mutual funds provide stability and income generation, with a strategic allocation to short-duration funds given the prevailing interest rate environment.

Shivakumar underscores the significance of thorough research and due diligence when selecting mutual funds, prioritizing those with a consistent track record of performance, low expense ratios, and experienced fund managers.

Term Insurance:

Term insurance serves as a crucial component of financial planning, offering protection and financial security to individuals and their families in the event of unforeseen circumstances. In 2024, amidst heightened awareness of the importance of insurance, Shivakumar advocates for term insurance policies tailored to individual needs and circumstances.

He emphasizes the need for adequate coverage to safeguard against life’s uncertainties, recommending a comprehensive assessment of liabilities, dependents, and future financial goals. With advancements in technology and underwriting processes, term insurance policies have become more accessible and affordable, making it prudent for investors to secure their financial future through adequate coverage.

Shivakumar advises investors to compare policies from reputable insurers, considering factors such as premium affordability, claim settlement ratio, and additional riders or benefits tailored to specific requirements.

Pension Transfers to India:

For non-resident Indians (NRIs) planning their retirement or considering repatriation to India, pension transfers represent a critical aspect of financial planning. In 2024, amidst evolving tax and regulatory frameworks, Shivakumar provides insights into optimizing pension transfers to India for maximum benefits and efficiency.

He emphasizes the importance of understanding the tax implications and eligibility criteria associated with pension transfers, considering factors such as residency status, double taxation treaties, and retirement age. With proper planning and guidance, NRIs can leverage pension transfers to India to enhance retirement income, optimize tax efficiency, and align with long-term financial goals.

Shivakumar advises NRIs to seek professional advice from qualified financial advisors or tax consultants with expertise in cross-border financial planning. By leveraging specialized knowledge and insights, NRIs can navigate the complexities of pension transfers and make informed decisions aligned with their unique circumstances and objectives.

In conclusion, the investment landscape in 2024 offers a myriad of opportunities across mutual funds, term insurance, NHs projects, and pension transfers to India. With the guidance of experienced professionals like Shivakumar A, investors can navigate these opportunities with confidence, building resilient portfolios and securing their financial future in the dynamic global economy.

Take control of your financial well-being with our services covering life insurance, health insurance, mutual funds (SIP), NHS pension transfers to India, share trading, and bonds.