Pitfalls of Online Insurance Purchase

Thank you for reading this post, don't forget to subscribe!A Cautionary Tale for Policyholders and Nominees

In the digital age, the allure of convenience has reshaped consumer behaviours across industries, with the insurance sector witnessing a significant shift towards online purchases. This digital revolution promises ease of access, speed, and efficiency, appealing to the modern consumer’s desire for instantaneous. However, this shift towards online insurance purchasing is not without its drawbacks. For policyholders and nominees, the digital path offers a bumpy ride, fraught with challenges that merit a closer examination.

The Illusion of Simplicity and the Reality of Complexity

On the surface, online insurance platforms market themselves as bastions of simplicity. Yet, the reality is that insurance products are inherently complex, requiring a nuanced understanding ensuring that the chosen policy matches the buyer’s needs and circumstances. The online process, streamlined for speed, often glosses over these complexities, leading to a scenario where policyholders may end up with coverage that is ill-suited to their requirements. The absence of personalized guidance exacerbates this issue, as individuals navigate these decisions without the expert advice that traditionally accompanies insurance purchases.

A Breeding Ground for Misinformed Decisions

The lack of direct, human interaction in the online purchase process can significantly disadvantage policyholders and nominees. When questions arise or clarifications are needed, the impersonal nature of online platforms can lead to unanswered queries or, worse, misinterpretations. The reliance on frequently asked questions (FAQs) and generic chatbots often falls short of addressing specific concerns, paving the way for misinformed decisions that could have long-lasting financial repercussions.

Data Privacy Concerns: The Invisible Threat

The digital footprint left by online transactions is a goldmine for data harvesters and cybercriminals. The process of purchasing insurance online requires the disclosure of sensitive personal information, putting policyholders at risk of privacy breaches and identity theft. Despite advancements in cybersecurity, the threat remains omnipresent, casting a shadow over the perceived convenience of online purchases. For policyholders and nominees, the implications of a data breach extend beyond the immediate financial loss, potentially leading to a lifetime of vigilance against identity fraud.

The Digital Divide: Not Everyone’s Online Utopia

The push towards online insurance purchases assumes a level of digital literacy and access that is not universally available. For certain demographics, including the elderly, those in rural or low-income areas, and individuals with disabilities, the digital divide is a stark reality. These groups are often marginalized in the rush towards digitization, finding themselves at a disadvantage, unable to access the same level of information, resources, or opportunities as their digitally-savvy counterparts. This divide not only reinforces existing inequalities but also limits the reach of insurance protection to those who may need it most.

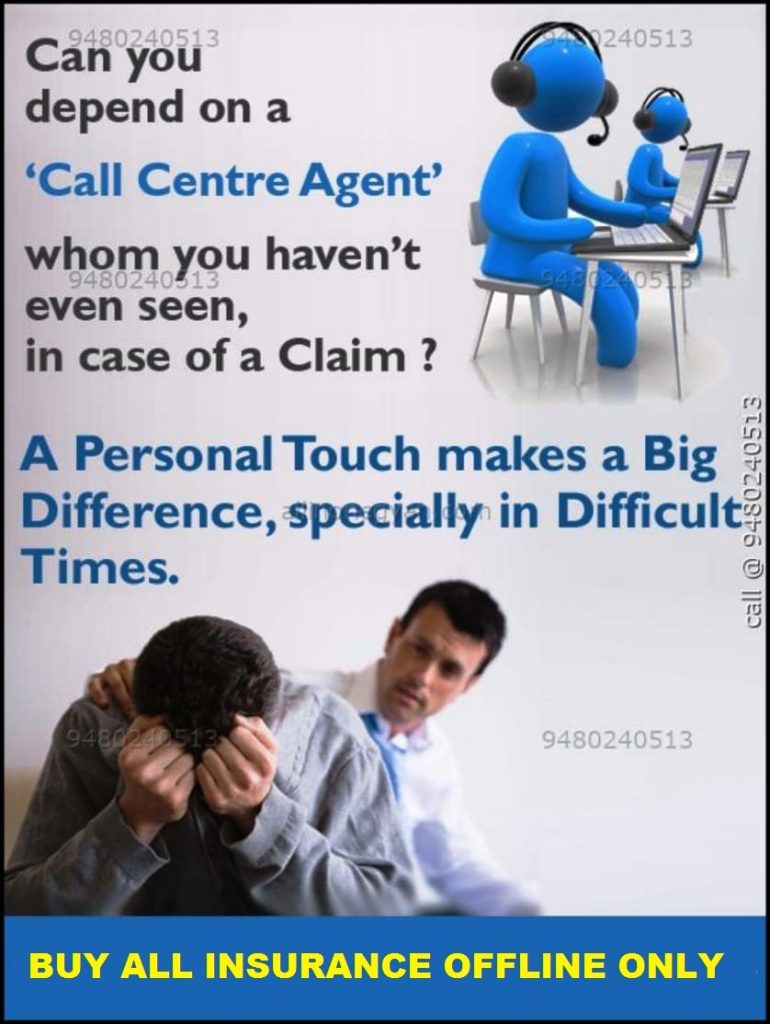

Impersonal Claims Processing: A Barrier to Compassion

In the unfortunate event of a claim, the impersonal nature of online interfaces can add to the distress of policyholders and nominees. Insurance, at its core, is a service industry, predicated on the principles of trust and support in times of need. The automated, often rigid processes of online claims submission can feel cold and unyielding, lacking the human empathy and understanding that are especially crucial during such vulnerable moments. This can result in a claims experience that feels isolating and uncaring, further compounding the stress of already difficult circumstances.

In conclusion, while the convenience of online insurance purchases cannot be understated, it is imperative for policyholders and nominees to tread this path with caution. The limitations and risks associated with online transactions necessitate a more critical approach, where convenience is balanced with informed decision-making. As the industry evolves, it remains crucial for insurers to address these challenges, ensuring that the digital transformation enhances, rather than compromises, the value and security offered to policyholders and their beneficiaries.

Any Insurance, Mutual Funds, NHS Pension transfers,

WhatsApp/ call 9972660645