Why LIC policy is good?

LIC policy is good for those who want to have their investment safe and secure. The investment in LIC policy depends on how much risk the investor wants to take. The proposer needs to choose between safety and returns. If a proposer is satisfied with 6 to 7% returns with Life Insurance, Double Accident cover, and tax benefits under 80C, then LIC plans are the best option.

Thank you for reading this post, don't forget to subscribe!To choose the best LIC policy as per your age, call 9886568000

If the investor is looking for more than 8% returns and is ready to take risks, then he should go for Mutual Funds.

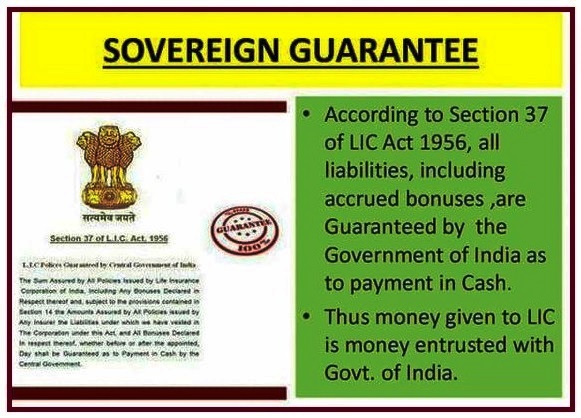

The main advantage of buying an LIC policy is the sovereign guarantee. According to Section 37 of the LIC Act 1956, all liabilities, including accrued bonuses, are guaranteed by the Government of India.

The basic advantage is that LIC’s regular plans are guaranteed (Please read the offer document ) by the Government of India. No other insurance company in India is having this benefit. So a policyholder can buy an LIC policy without any fear of losing money.

Which LIC policy is good to buy?

LIC plans are designed to suit the common people. All plans are designed in such a way that it fulfills the needs and celebrate some occasion in life. From childbirth to retirement, there are plans which can be planned as per the needs of the proposer.