Thank you for reading this post, don't forget to subscribe!

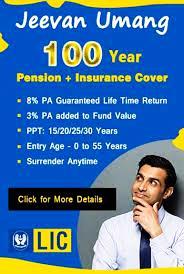

LIC Jeevan Umang plan

LIC Jeevan Umang Plan, from LIC of India, is a participatory endowment plan, offers regular income and risk cover. A perfect plan suitable all your needs, like child education with guaranteed returns from 16th year, lump-sum payment for marriage, etc., Some can also plan for a lifelong pension from 16th year onward. There are 4 modes of premium terms under this plan, which can be chosen at the beginning of the policy.

The future cannot be predicted at the same time, it can be planned well in advance. The LIC Jeevan Umang Plan gives you all the benefits.

Tax Savings with LIC Jeevan Umang Plan

LIC Tax Savings Plans are many, but this plan would give dual tax benefits, which makes this plan very popular among all. All premiums paid to this plan may be considered under Section 80C, and returns are 100% tax-free under Section 10 (10 D) of the Income-tax act.

A plan that allows you to withdraw fully or leave it with LIC of India, gets tax-free yearly money-back till your 100th birthday. In case of any eventuality during the term of the policy or after the Money-back starts, a lump sum would be paid to the nominee.

LIC Jeevan Umang plan Features

- Minimum Basic Sum Assured: Rs. Rs.2,00,000 in multiples of Rs. 25,000

- Entry age: 90 days to 55 years.

- The maximum age of maturity is 100 years

- Premium paying terms: 15, 20, 25, and 30 years

- The date of commencement of risk begins immediately if the policyholder is 8 years of age or older. For those below 8 years, the risk commences one day before 2 years are completed or one day before the policy anniversary coinciding with the completion of 8 years of the life insured.

Benefits under LIC Jeevan Umang Plan are:

- A survival benefit equal to 8% of the Basic Sum Assured shall be paid each year if the policyholder survives through the policy term. The first survival benefit is compensated at the end of the premium paying term and continues each year till the anniversary prior to the maturity date or till the policyholder lives.

- At maturity, sum assured along with vested Bonuses are paid, provided all due premiums have been submitted for the LIC Jeevan Umang Policy

- The death benefit is paid to the beneficiary in the event of the unexpected death of the life insured. The Sum Assured on Death should not be less than 105% of all the premiums paid till the date of death. The sum assured on death is the highest of the Basic Sum Assured, or 10 times the annualized premium.

- If the policy continues after its premium term, it may participate in future profits

Additional benefits offered under LIC Jeevan Umang Plan

- Lifetime Tax-free income

- Accidental Death and Disability Benefit Rider

- New Term Assurance Rider

- New Critical Illness Benefit Rider

- Tax Benefits under section 80C and 10 (10 D)

LIC agent is pleased to explain all LIC Jeevan Umang Plan details and clear your doubts

FAQs

Can I cancel my LIC Jeevan Umang Plan after paying a premium for 1 year?

You can stop the policy at any time, but you may not receive any benefits. Premium paid for continuous 3 years would get some benefit.

Can we avail of a loan on the LIC Jeevan Umang Policy?

Yes, after 2 years of continuous premium payment and at the beginning of the 3rd year surrender, the value can be obtained.

Is life covered from day one?

Yes, insurance coverage would start from the day the policy number is issued.

If I have an accident during the policy term, will LIC pay me the accidental benefit?

Under this policy, the accidental rider is optional and available only on paying an extra premium amount. If the rider is chosen, the nominee would get the additional sum assured on the death of the insured due to an accident.

Can I increase the insurance coverage after one year?

Yes, you can buy a new policy. The existing policy, insurance coverage cannot be changed and will continue to be the same throughout the term.