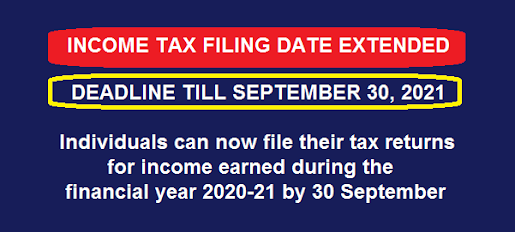

This year, the financial year 2020-2021 has come to an end without any big announcements like every year. But most of the things are as normal as they were. Get ready to file your income tax returns on time. The Income Tax Department had also set a deadline for filing Income tax returns for the Assessment year 2021-22.

Thank you for reading this post, don't forget to subscribe!

The Finance Ministry’s Central Board of Direct Taxes (CBDT) also extended the ITR filing deadline for companies by a month until November 30. The government has extended the time limits for certain tax compliance due to the spread of the Corona pandemic disease and a continuous lockdown in the country. The deadline for taxpayers, like corporations and others, whose accounts are required to be audited is extended from October 31 to November 30, 2021.

The earlier date for filing TDS returns and SFT statements was May 31st, 2021. This had been extended until June 30, whereas the corresponding due dates for the issuance of TDS certificates were also extended by one month to July 15.

Other filings, like belated and revised returns for all categories of taxpayers, have been extended by one month from December 31, 2021, to January 31, 2022.