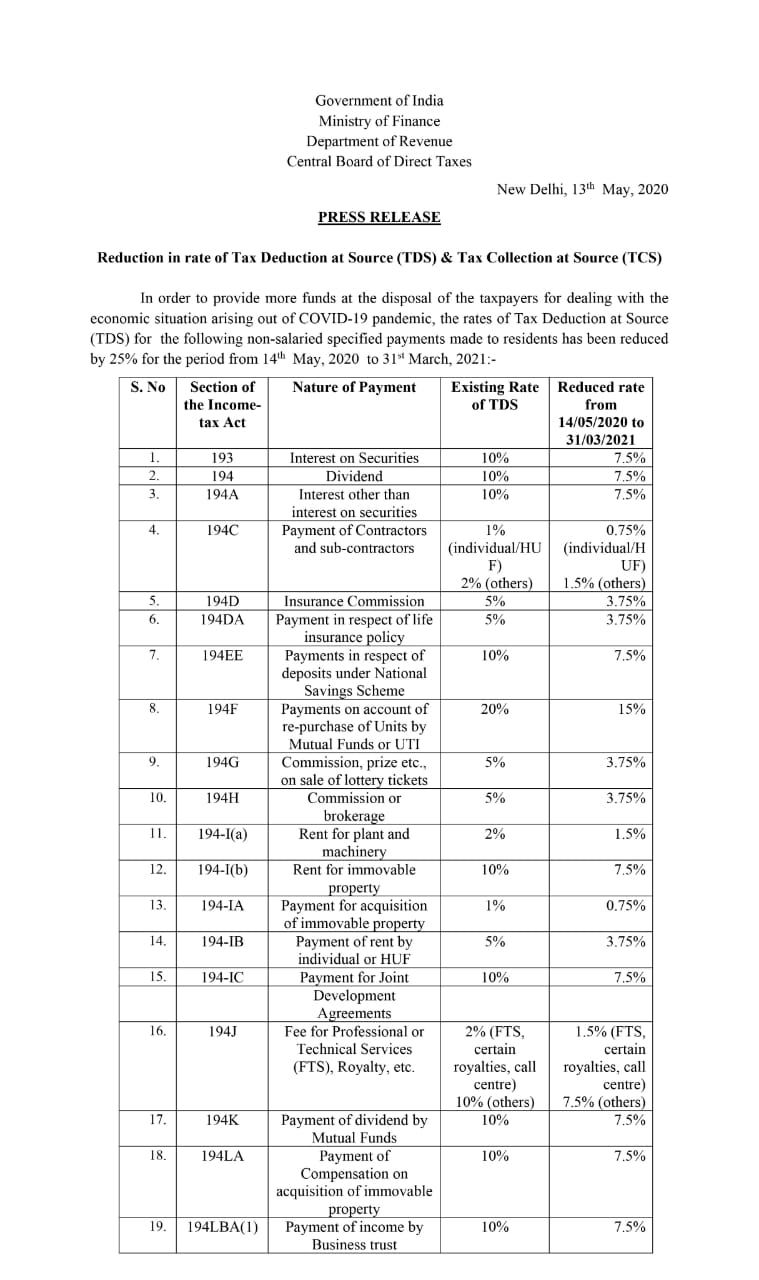

Government of India had reduced the rate of Tax Deduction at Source ( TDS) & Tax Collection at Source (TCS) on the following items from 14 May 2020 to 31st March 2021 as follows :

Thank you for reading this post, don't forget to subscribe!- Interest on securities, dividend,

- Interest other than interest on securities,

- Payment of Contractors and Sub-contractors,

- Insurance commission,

- Payment in respect of deposits under National Savings Scheme,

- Payments on account of re-purchase of Units by Mutual Funds or UTI

- Commission, prize etc., on sale of lottery tickets,

- Commission or brokerage,

- Rent for plant and machinery,

- Rent for immovable property,

- Payment of rent by individual or HUF,

- Payment for Joint Development Agreements,

- Fee for Professional or Technical Services ( FTS), royalty, etc.,

- Payment of dividend by Mutual Funds,

- Payment of compensation on acquisition of immovable property

- Payment of Income by Business trust